Prepare for

the Future.

Live Your Best

Life Today.

Exit planning, retirement, & wealth strategies

for business owners.

Prepare for

the Future.

Live Your Best

Life Today.

Exit planning, retirement, & wealth strategies for business owners.

Financial Strategies

for Business Owners

We work with our clients to ensure they:

Have a diversified net worth and consistent income setting them up for a comfortable retirement and life after business.

Own a profitable, scalable, and sellable business that increases in value over time.

Make sound financial decisions that allow them to spend their time on what they value in life.

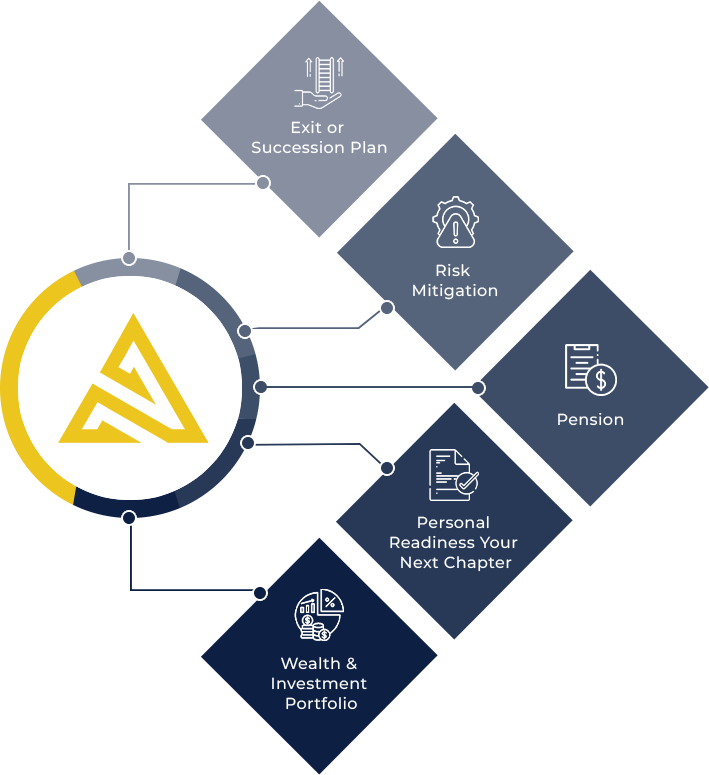

Approach Services

Advanced Tax Strategies for Business Owners

Save taxes now and build a nest egg for the future with IPP and RCA pension plans for owners. Canada's best kept secret!

Exit & Succession

Planning

Every owner exits eventually. Increase business value & prepare for sale or passing to the next generation.

Total Wealth

Management

Comprehensive advice and wealth management strategies that take into account all facets of your life and business.

Are you

Personally ready

to exit your

business?

75% of business owners regret selling their businesses.

PREScore™ (or Personal Readiness to Exit Score) is an online questionnaire that evaluates your readiness to exit your company on a personal level. Spend a few minutes answering simple questions, and you’ll receive a detailed report identifying your status on each of the 4 drivers of a satisfying exit.

The assessment takes less than 8 minutes to complete and is completely free. Click the button below to take the first step towards a happy (and lucrative) exit.

"Since we started working with you, I’ve had a lot of peace. You give that to me.

I’ve had a car guy, a guitar guy, and now I have a money guy."

CEO Founder

MEET FRASER

ORR-BROWN

My goal is to help my clients strike a balance between securing their future and enjoying the present.

I want to ensure that they don’t just work tirelessly with the

hope of enjoying life later, only to have unforeseen circumstances disrupt those plans.

By aligning financial strategies with personal values and goals,

I aim to help business owners live fulfilling lives both now and in the future.

Your first step is a free consultation call to see if we’re a good fit to work together. Click the button to set up a time I’m looking forward to meeting you!

Free E-Book: The Freedom Point

As a business owner, you typically face two difficult choices:

- When to sell your business

- At what price to sell it.

Selling your business may seem far off into the future, but if exiting your business now would give you the financial resources to do whatever you want, it may be worth considering sooner than feels natural.

This eBook offers a simple methodology you can apply to reach financial independence – what we call The Freedom Point. You may be closer to a carefree life than you think.

You’ll discover:

How to determine if you’ve passed the Freedom Point.

A step-by-step process for calculating your Freedom Point.

3 financial options faced once you’ve reached Freedom Point

What our Clients are Saying

Given our commitment to client confidentiality, the testimonials featured on this site

do not include client names and utilize stock portraits for privacy reasons.

Rest assured, these testimonials are genuine. Personal references are available upon request.

Latest Insights

How Smart Business Owners Can Use an RCA to Extract Wealth from Their Business (and Save Taxes)

An RCA lets you draw money from your business, reduce taxes, and stay in control during transitions. Here’s why it’s worth a look.

The Keys to Successful Investing: Diversification, Cost-Effective Strategies, and Managing Emotions

Successful investing is about strategy, not trends. Diversify, minimize fees, and manage emotions to build long-term wealth. Learn how small-cap stocks boost returns, avoid costly fees, and stay disciplined for financial security.

How an Individual Pension Plan (IPP) Can Save Canadian Business Owners Thousands in Taxes

Canadian business owners face rising taxes, but an IPP offers a solution. With higher contribution limits than an RRSP, it defers taxes, protects assets, and grows savings. Learn how one owner saved $24K in a year—and how you can too.

Top 10 Underutilized Tax Strategies for Canadian Business Owners

Paying too much tax? Many Canadian business owners miss key savings. These 10 tax strategies, from IPPs to spousal loans, can help you keep more money in your business. Explore which ones work for you.

Get in Touch With Us

CONTACT US

We are a great fit for clients who

Want to collaborate with someone they can trust to manage the complexity of a business transition.

Own privately held businesses that generate over $1 million in annual revenue.

Appreciate professional guidance for financial, tax, and investment decisions.

If this is you, contact Fraser of Approach Advisory for an assessment of your business value. We’ll help you develop a structured approach to your business exit plan so you can live your vision for the future.